Live Balancing Mechanism calculations

Get NIV and system price, realtime, for free. No more waiting for Elexon to publish them 1 hour after the event!

TLDR: The Balancing Mechanism is really important for batteries, and it is tricky to get realtime, accurate information on it.

We calculate live System Price and Net Imbalance Volume based on Balancing Mechanism actions taken by NESO. These datasets are free for anyone to use, and can be found on the Modo API.

Head to the Energy Academy to learn more about the Balancing Mechanism

What is system imbalance?

NESO balance electricity supply and demand in Great Britain. One of the tools they use is the Balancing Mechanism. The Balancing Mechanism is governed by the Balancing and Settlement Code (BSC), which we can assure you is a fascinating bedtime read. The BSC is administered by Elexon, and they're responsible for determining which parties are 'out of position', and as a result, how much money they owe or are owed.

Two of the most important Balancing Mechanism metrics are Net Imbalance Volume (NIV) and the System Price (also called the Imbalance Price, or System Sell Price, or System Buy Price, or System Cashout).

- NIV is a measure of the net volume of balancing actions taken by NESO to match supply and demand during each settlement period. A positive NIV implies the system is short - ie demand is greater than generation, and vice versa for a negative NIV.

- System Price reflects the marginal cost that these balancing actions cost NESO, and is the price that 'out of position' parties are paid by, or pay, to Elexon.

- Each half-hour of the day, or each settlement period, has a value of NIV and system price. Elexon publish these about 1 hour after the end of each settlement period, and then continue to re-adjust them up to 6 months later (with later 'settlement runs').

How do we calculate NIV and system price in real-time?

For a detailed explanation on how imbalance pricing works, you can read thisexplainer by Elexon. Most of the relevant details are below.

We receive bid-offer acceptances and balancing system adjustment actions from NESO, and together these represent the balancing system actions that impact NIV and system price.

In each settlement period, we take each Balancing Mechanism unit's declared position:

- its final physical notification (ie what they plan to generate 1h before the start of the settlement period),

- bid-offer pairs (ie what it will cost NESO to change the output of the unit),

- and any bid-offer acceptances (ie the changes NESO has asked them to make).

By comparing bid-offer acceptances (BOAs) to the final physical notification and bid-offer pairs for the relevant settlement period, we can calculate the volume and price of each BOA. The sum of the volume of all these BOAs and balancing system adjustment actions (BSAAs) is NIV.

System price represents the most expensive (to NESO) 1 MWh of balancing actions. Some actions are removed from this calculation, such as actions under 0.1 MWh (DMAT Tagging) and actions which don't contribute to NIV (NIV Tagging). Flagged actions (STOR actions, system balancing actions, and actions lasting under 10 minutes) are sometimes repriced so that they don't raise the system price above the price of unflagged actions.

These are NOT forecasts

The values we publish do not represent a projection of NIV or system price at the end of the settlement period.

Instead, we are taking all the relevant information that has been published and following the processes laid out in the balancing and settlement code to calculate what NIV and system price currently are.

If no further actions are taken by NESO for the remainder of the settlement period, and we've received details of all the balancing actions taken, then our published values will equal the official values Elexon publish.

Occasionally, the final Elexon system price is a bit different to ours

- There are multiple settlement runs when Elexon update the calculation, after additional metering data is collected. This can change the numbers.

- For example, the final settlement run takes into account actual metering data to calculate transmission loss multipliers. We don't have access to this metering data in time, so the volumes may change slightly, and so also the price.

- There are also occasions when we don't receive all of the data on the balancing actions taken in time, especially for BSAA actions.

So, there might be some cases where the final system price is a bit different to ours, but the differences (particularly in price) are usually small.

How accurate are these calculations?

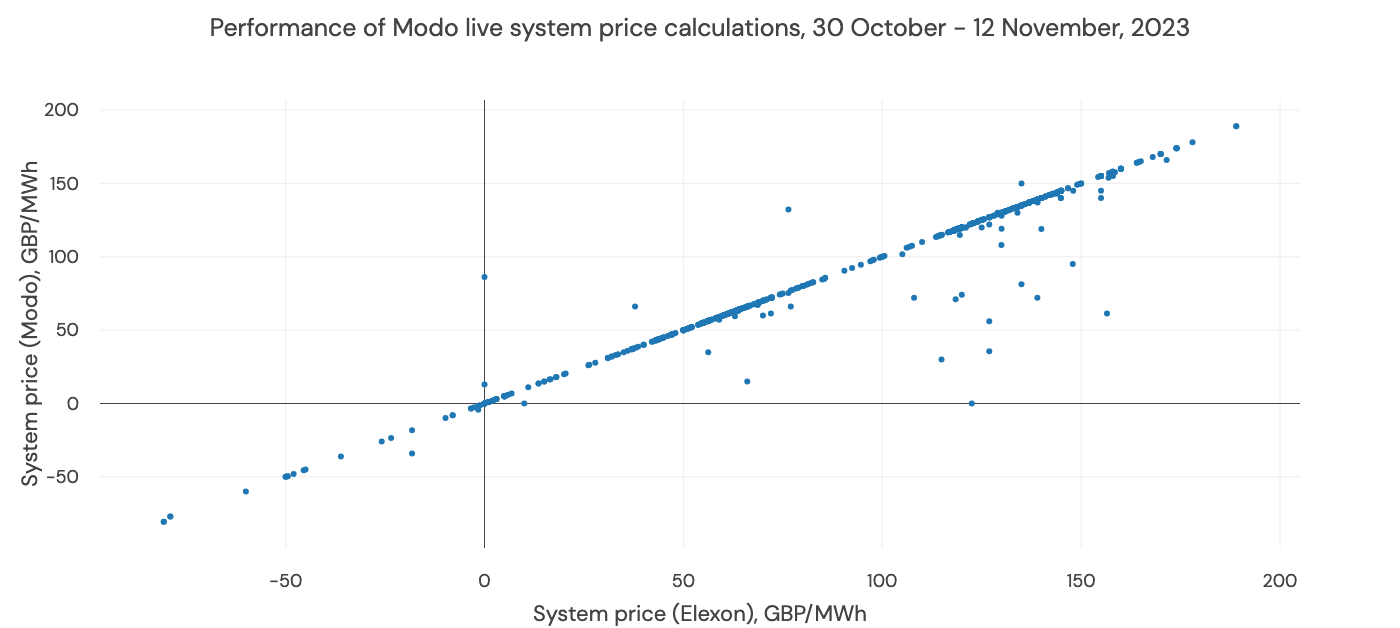

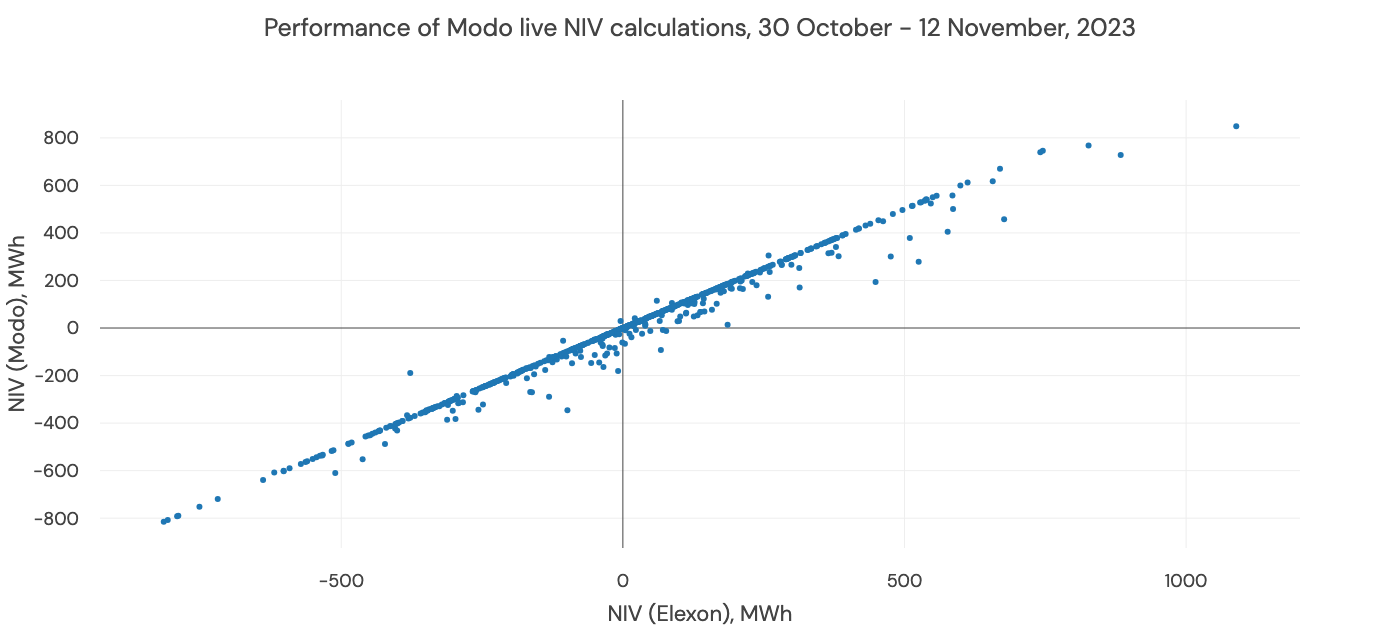

The charts below show Modo's live calculated values of system price and NIV against the official values published by Elexon over a two week period at the beginning of November 2023.

For this period, we were within 1% of Elexon's official values in 92% of settlement periods for system price, and 73% of periods for NIV.

System price has higher accuracy because small errors in NIV often don't change the marginal action (which sets system price).

We receive more than 99% of balancing actions by volume

When we get all of the data into our systems in time to make the calculation (57% of the time), our live NIV and system price exactly line up with Elexon's values.

The rest of the time, we miss a very small percentage of balancing actions - 0.7% of total dispatched volume across this two week period.

Missed actions have two root causes:

- The details of some BSAAs aren't published during the settlement period. The ESO don't always publish details of BSAAs within the settlement period, as they are allowed to submit them to Elexon up to two working days after delivery. BSAAs can represent significant balancing volume, so there are some periods where major balancing actions can't be included in our live calculations. Unfortunately there's nothing we can do about this.

- We don't receive a balancing action in time to show it on the market screen. Our live calculations currently run about 4 minutes behind real-time. That is to say, there is a delay between an action being issued by the ESO and it appearing in our datasets. We're working hard to reduce this delay as much as we can, but for now, actions issued in the final 4-5 minutes of a settlement period are unlikely to be shown on our market screens.

When actions are missing, the Modo System Price calculation can outturn differently to the Elexon one. Across this 2-week period:

- When NIV was positive (ie the system was short), the mean difference in price was £-2/MWh (with a standard deviation of £12.60/MWh).

- When NIV was negative (ie the system was long), the mean difference in price is £-0.13/MWh (with a standard deviation of £4.90/MWh).

Overall, we were within 1% of Elexon's official values in 92% of settlement periods for system price.

Updated 4 months ago